U.S. Department of Labor Adopts Final Rule Increasing Minimum Exempt Salary

On April 23, 2024, the U.S. Department of Labor (Department) announced a final rule increasing the minimum salary required to properly classify employees as exempt from federal minimum wage and overtime. The first change outlined in the rule went into effect on July 1, 2024, with a subsequent change effective January 1, 2025.

Under the federal Fair Labor Standards Act (FLSA), which is silent regarding its applicability to Tribal Nations and their enterprises, covered employers are required to pay employees minimum wage for every hour worked and overtime for every hour worked in excess of, usually, 40 hours in a work week, except for employees that the employer can properly classify as “exempt” from these rules. The most commonly utilized exemptions are sometimes referred to as the “white collar” or “EAP” exemptions and apply to employees who perform exempt executive, administrative, professional, outside sales, and computer duties and, who generally receive a guaranteed salary of at least the minimum required amount (currently, $684/week under federal law). The FLSA also provides a special exemption for certain “highly compensated employees,” the “HCE” exemption, who make above a certain amount (currently, $107,432 in total annual compensation under federal law) and meet a less stringent duties test.

The Department’s newly final rule, Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees, increases the federal minimum salary threshold required for most EAP exemptions and the HCE exemption. Of note, the final rule does not modify the exempt duties, which are also required to properly classify an employee as exempt under the FLSA’s EAP and HCE exemptions. The final rule:

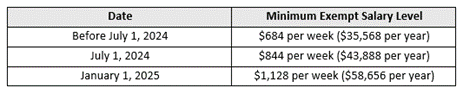

- Increases the federal minimum required guaranteed salary level for the EAP exemption in two steps (as outlined below):

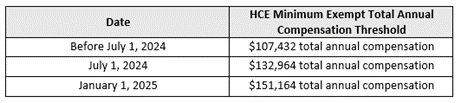

- Increases the federal total annual compensation threshold for the HCE exemption in two steps (as outlined below):

Adds a mechanism that will provide an automatic update to these federal minimum salary and compensation thresholds every three years beginning on July 1, 2027.

Adds a mechanism that will provide an automatic update to these federal minimum salary and compensation thresholds every three years beginning on July 1, 2027.

In the past, modifications to the FLSA’s EAP exemptions’ salary thresholds have drawn legal challenges that resulted in an injunction preventing the implementation of the changes. While several challenges have been filed, none of them have broadly invalidated the implementation of the final rule. We will provide updates to the extent such challenges have a broad-scale impact.

When the second stage of the rule goes into effect in January 2025 the federal minimum salary level for EAP exempt employees will have increased by 65%, a percentage increase that will have a significant financial impact on many employers.

In preparation for the implementation of the second stage of the final rule, Tribes and enterprises that conform to the requirements of the FLSA should review the salaries/compensation thresholds of their exempt employees to assess which, if any, employees’ salaries/compensation thresholds are below the January 1, 2025 federal salaries/compensation thresholds outlined in the final rule. In that event, the employer will need to decide whether to raise the pay of such exempt employees or reclassify such employees as non-exempt and overtime eligible.

Drummond Woodsum’s team of experienced Employment and Labor attorneys are available to answer your questions about how these changes will affect your organization and how to navigate compliance with these new standards. Please do not hesitate to reach out to a member of our team with any questions.